At Profluo, we firmly believe that AI-enabled, detailed, and accurate recording of financial transactions forms the indispensable bedrock for effective AI analytics once those transactions are posted to the ERP system.

Without this solid foundation, any subsequent AI-driven insights would be inherently flawed, leading to poor decision-making. This is fast becoming a moral imperative for the modern finance function.

The new role of AI in recording

The initial phase – recording transactions such as invoices, receipts, and cash movements – is where AI first proves its value. It’s about ensuring the quality, granularity, and completeness of the data before it becomes the raw material for advanced analysis.

Data Quality and Integrity

- Accuracy: AI tools using techniques such as Optical Character Recognition (OCR) and Natural Language Processing (NLP) can extract data from unstructured documents (invoices, receipts) with far greater precision than manual entry or older, template-based automation. They minimize human error (typos, miscodings) at the source.

- Completeness: AI can flag missing information or inconsistencies (e.g., an invoice without a valid PO number or a receipt lacking a date), ensuring that the dataset is comprehensive before posting.

- Standardization: AI can automatically map varied vendor descriptions and transaction types to a unified chart of accounts or taxonomy, ensuring consistency across the enterprise – crucial for cross-entity analysis.

- Control and validation: AI can identify genuine fraud or compliance issues (e.g., duplicate payments, unusual vendor changes), avoiding false positives caused by messy data.

Granularity and Detail

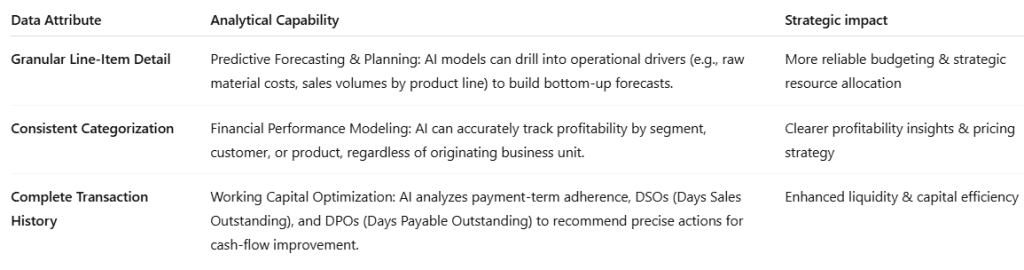

AI doesn’t just record amounts; it enriches them with predictive metadata often overlooked in manual processes. For example:

- Invoice line items: AI can infer product codes, ledger accounts, controlling dimensions, and applicable tax regimes – all essential for spend analysis and cost-to-serve calculations later.

- Receipt categorization: Beyond the standard expense type, AI can identify the specific merchant, location, and even link it to a project or internal cost center with high accuracy.

Proper AI-enabled recording and enrichment of transactions create a highly contextual financial dataset. This rich context becomes a gold mine for any LLM-enabled agent, fueling both action and analysis.

How a solid goundation fuels AI analytics

Once this high-quality, granular data is posted to the ERP (Enterprise Resource Planning) system, it becomes the cognitive General Ledger. This clean, intelligent foundation enables advanced AI analytics to deliver true strategic value.

The core debate still centers on the timeless principle: “Garbage In, Garbage Out.” If the data posted to the ERP is inaccurate, incomplete, or poorly coded, even the most sophisticated AI algorithms will yield misleading conclusions – or worse, systemic errors.

AI-enabled transaction recording is not merely a tool for efficiency; it is a strategic data governance mechanism. By cleaning and enriching data at the source, it ensures that ERP data – the single source of truth – becomes a reliable input for analytical AI.

This transforms financial analysis from a rear-view mirror exercise into a powerful, predictive engine for the business and it is critical for the modern CFO seeking to drive strategic value.

Build your financial AI on solid ground

Profluo ensures every transaction is captured, enriched, and posted with precision, so your analytics, forecasts, and insights start from truth, not noise. Discover how Profluo transforms financial data quality!